While in pillar 2 individual risks are amalgamated in a collective agreement, elipsLife Tria offers flexible and individual solutions in pillar 3 for covering the risks of death and disability. elipsLife offers its distribution partners – such as brokers, pension schemes, companies, banks and associations – these individual insurance solutions for covering the risks of death and disability on an exclusive basis.

Private pension — elipsLife Tria

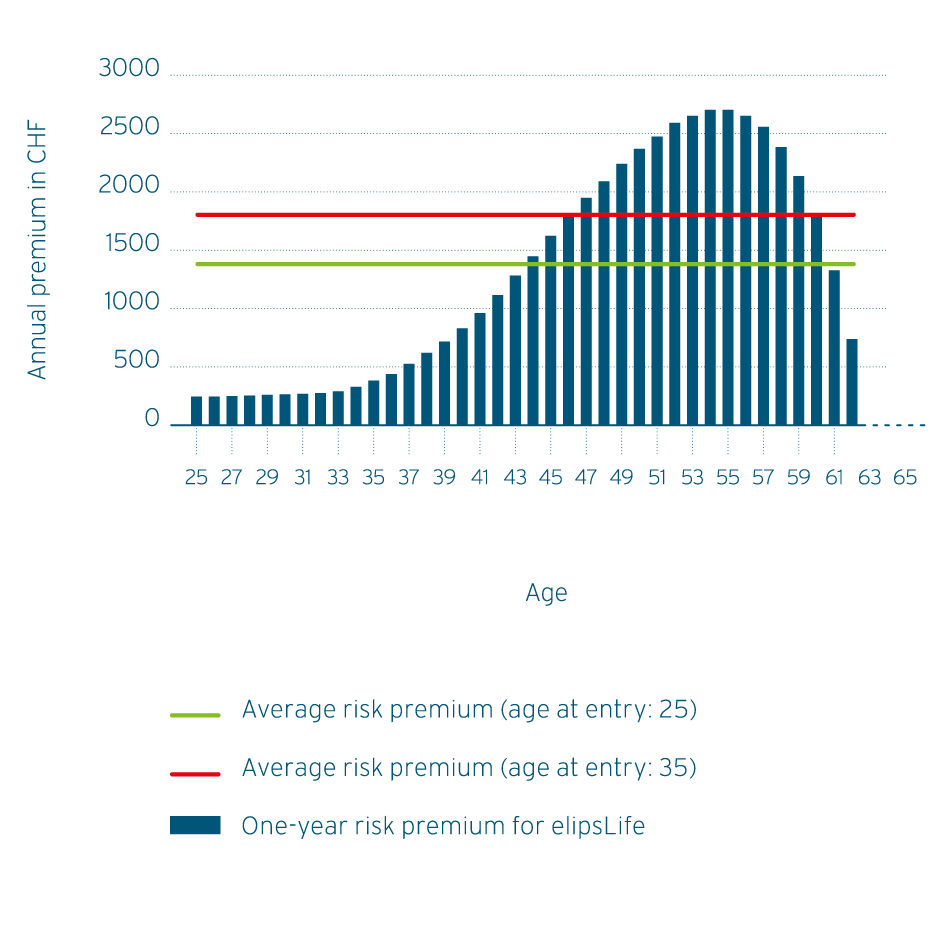

One of the major advantages of elipsLife Tria is that its premiums are based on annual tariffs. This means that, unlike for comparable products, it is only ever necessary to pay the premium corresponding to the risk. The insurance solution from elipsLife is cost-effective compared to other products on the market and is transparent in every respect as it is a pure risk insurance.

Tria Classic: death and disability cover in pillar 3b

In the event of death, a single lump sum is insured. With the classical disability cover, the disability standard of Swiss disability insurance is used, under which a pension is paid out from as little as a 25% degree of disability.

How are the premiums in pillar 3 structured?

In this age of patchwork families, new family structures and changing familial relationships, there is demand for flexible pension solutions in pillar 3. It is therefore essential that risk premiums can be easily adjusted to changing life situations without any financial losses – this may include, for example, if a person changes job or if their personal circumstances change.

elipsLife Tria offers cost-effective and transparent premiums. The risk premiums depend on a person’s age and always correspond to the insured person’s current benefits subject to the risk.

Example of a risk-adjusted premium structure: occupational disability pension

Example: With a disability benefit of CHF 72,000, a 40-year-old pays an annual premium of around CHF 1,800 at competitors that apply average premiums. By contrast, elipsLife only charges a risk-adjusted annual premium of CHF 850.

This risk-adjusted premium structure has the following advantages over classical models that apply average premiums:

• The premium and the insurance risk always relate to the same

insurance year.

• The premium is transparent for every insurance year.

• The amount of cover can be adjusted at any time by the insured

person. The insured person can also terminate the cover at any time

without losing any excess premium components that have been

overpaid at that time.

• The product spans the life cycle ideally and can be adjusted at any

time.