Daily sickness benefits insurance

Daily sickness benefits insurance (KTG)

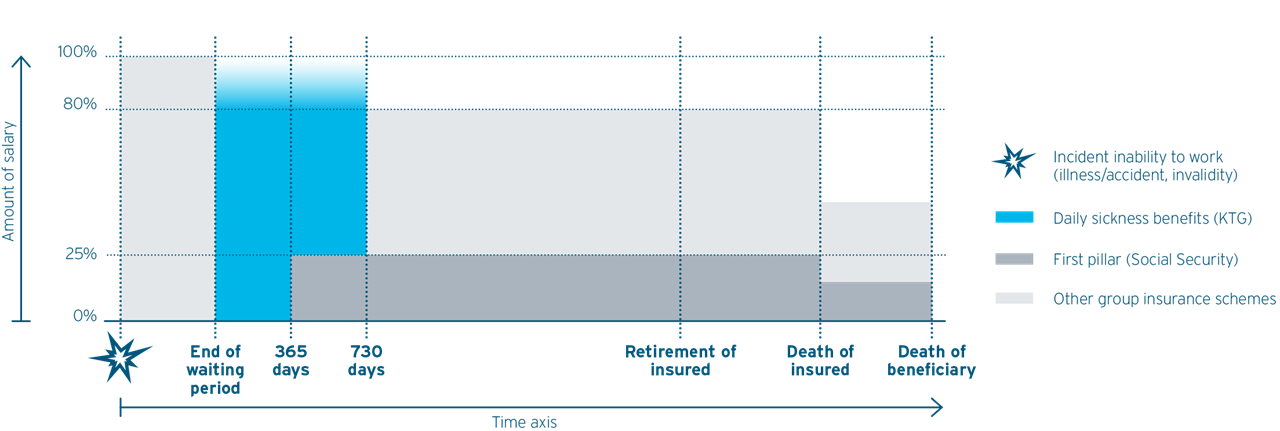

With elipsLife’s daily sickness benefits insurance, companies can provide their employees with the optimum protection if they are unable to work. This comprehensive insurance takes care of any gaps in cover and pays the insured benefits selected by the employer. In addition, real BVG coordination can be achieved with a downstream employee benefits solution from elipsLife.

Because of the employer’s obligation under the Swiss Code of Obligations to continue salary payments, daily sickness benefits insurance reduces the employer’s risk of paying a salary without receiving any performance while providing the employee with comprehensive protection. The insured company not only minimises its risks, but also benefits from the care given to employees who are absent for a longer period. The employer thus meets its obligations under labour law or exceeds them to the benefit of its employees.

The waiting periods and concepts of cover can be adjusted to the financial strength and risk structure of the company. Individual, flexible solutions tailored to the needs of the company can be implemented in different versions with the products offered by elipsLife. Sector-independent as well as sector-dependent pool solutions are also always available.

Special requirements — such as employees working abroad (expatriates), employees taking unpaid leave, lump sums payable at death or cover for key persons — are taken into account and the perfect solutions are designed individually. This is supplemented by the standardised SME business, which can be implemented quickly and is known for its efficiency and transparency. elipsLife also offers solutions for company owners with a fixed salary, for whom accident cover can be included.

The rates applied to individual risk solutions are based on multiple factors and correspond to the most modern risk models.

Care Management helps companies with prevention and support for repeated absences and the reintegration of employees. As Care Management helps to avoid or reduce long-term absences, it substantially increases the productivity of the insured company. It also sustainably stabilises or reduces the costs for daily sickness benefits insurance.

When are innovative solutions needed for the daily sickness benefits insurance?

Case 1

An insurance product can neither prevent the absence of an important employee (key person) nor compensate for the related loss in know-how or networks.

However, elipsLife can offer the company economic security and stability and cushion the financial impact of the loss as best as possible. Company owners also have voluntary options to insure a fixed component of up to 100% of their salaries.

Case 2

Companies want to provide the best possible cover for the surviving dependants of their deceased employees and cushion the financial loss in an emotionally trying time with a death lump sum.

To this end elipsLife offers supplementary daily sickness benefits cover that includes a death lump sum.

Case 3

With a traditional daily sickness benefits product, absences during the waiting period can become a burden on the company, particularly for large customers bearing a big share of the risk themselves.

To relieve the burden on these companies, elipsLife offers special insurance cover for short absences.