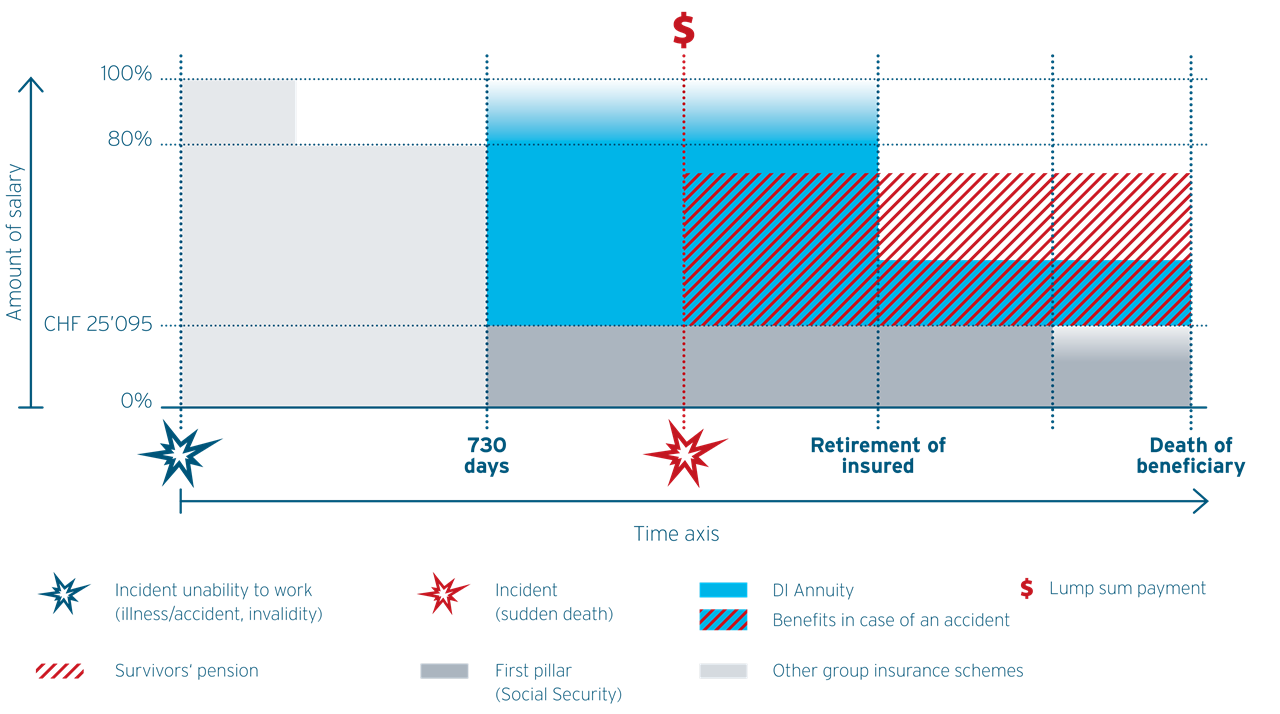

The pension fund can assign the biometric risks of disability and death to elipsLife by taking out second pillar reinsurance cover.

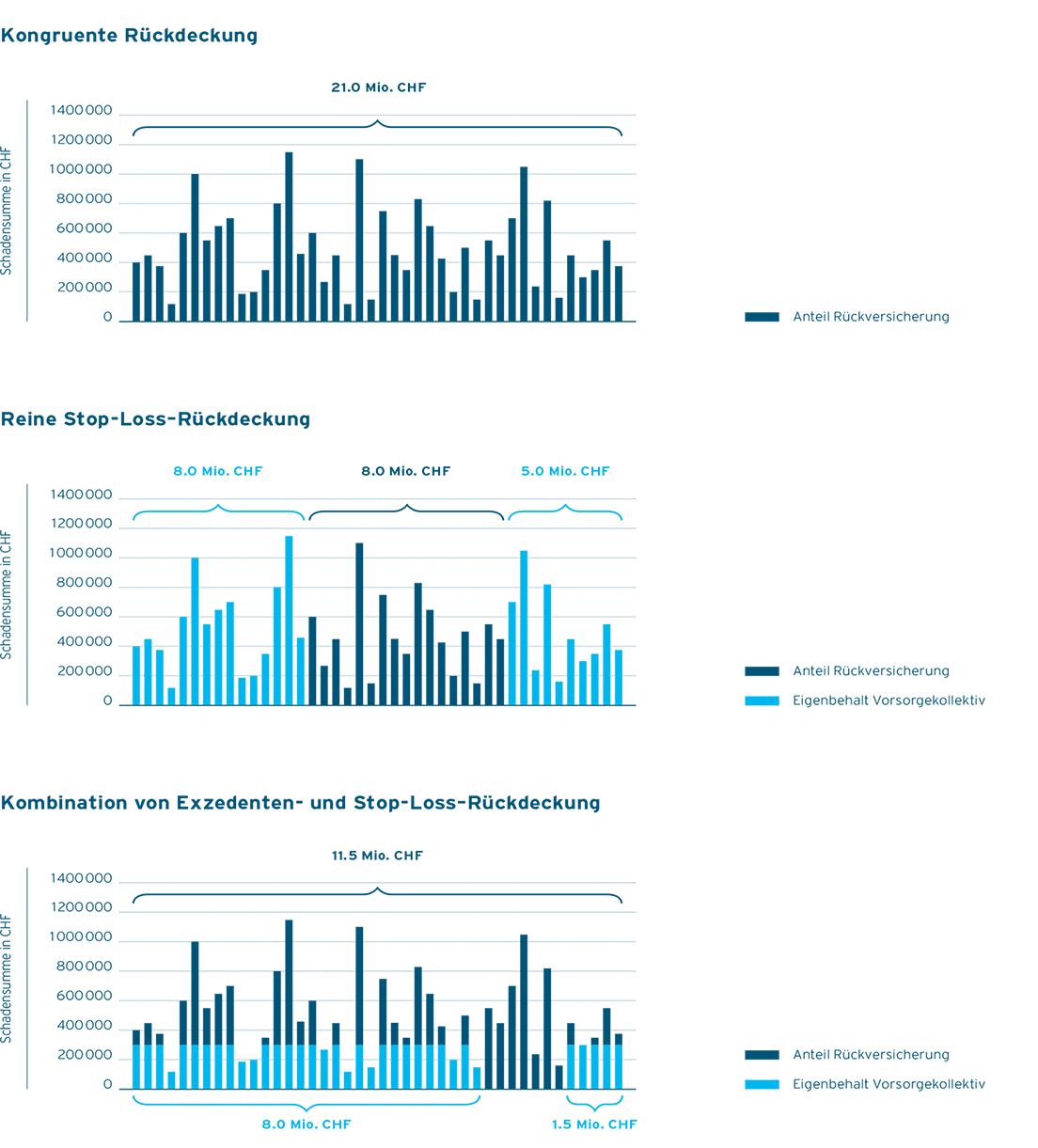

Customers of elipsLife have access to a wide range of reinsurance options that allow the transfer of risk in a manner suited to the pension fund’s risk capacity and risk appetite. Apart from the full assumption of the biometric risks, elipsLife also offers attractive options for the partial transfer of risks (selected risks).