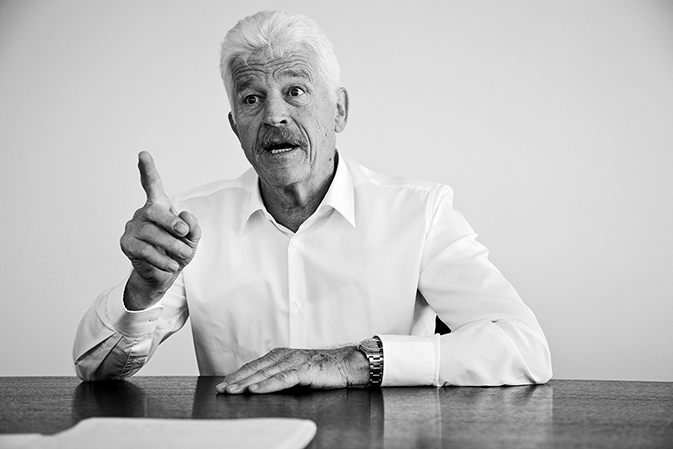

echo-interview with Benedikt Weibel, Ex-Swiss Federal Railways (SBB) boss

elipsLife echo: Mr Weibel, you reached retirement age a good year ago, but you are still active as author, speaker, professor and director. We are assuming that it cannot be the meagre benefits paid by the SBB pension fund that are driving you to be so active, or are we wrong?

Benedikt Weibel: My current activities do not have anything to do with the benefits paid by the SBB pension fund, although they are certainly related to the pension fund per se. Except for the pension from the Old Age and Survivors’ Insurance (AHV), which I have been receiving for about a year, I do not receive any pension. When I stopped working for the SBB at the age of 60, I requested the lump-sum payment of my entire pension fund capital after obtaining a lot of good advice. I invested this money with an insurance company, and I am still paying contributions. When I am 70, I will withdraw my capital. Even though the economic situation has changed in the past six years, I have not had reason to regret my decision.

You were with the SBB for a total of 28 years, from 1993 to 2006 as the Chief Executive Officer. As the boss, how did you see the SBB pension fund, and what role did the pension fund play in strategic company decisions?

The pension fund was one of my biggest problems, and from 1993 to 2006 we were embroiled in a permanent battle on all fronts. In 1993 we were stuck in a classic turn-around situation. In the previous five years, personnel expenses rose from CHF 2.5 billion to more than CHF 3 billion and we had to drastically reduce our personnel expenses. Personnel expenses can be influenced via three factors: the number of employees, salaries and the pension fund. During my time as CEO of the SBB, we reduced the number of employees by 12,000 people. In 1996, salaries were reduced and frozen for two years. We could not, however, take our own decisions regarding the pension fund. Although we had our own pension fund, the articles of association were approved by Parliament, and we also had to duplicate the decisions of the Swiss Federal Pension Fund.