Totaaloplossingen en eersteklas service

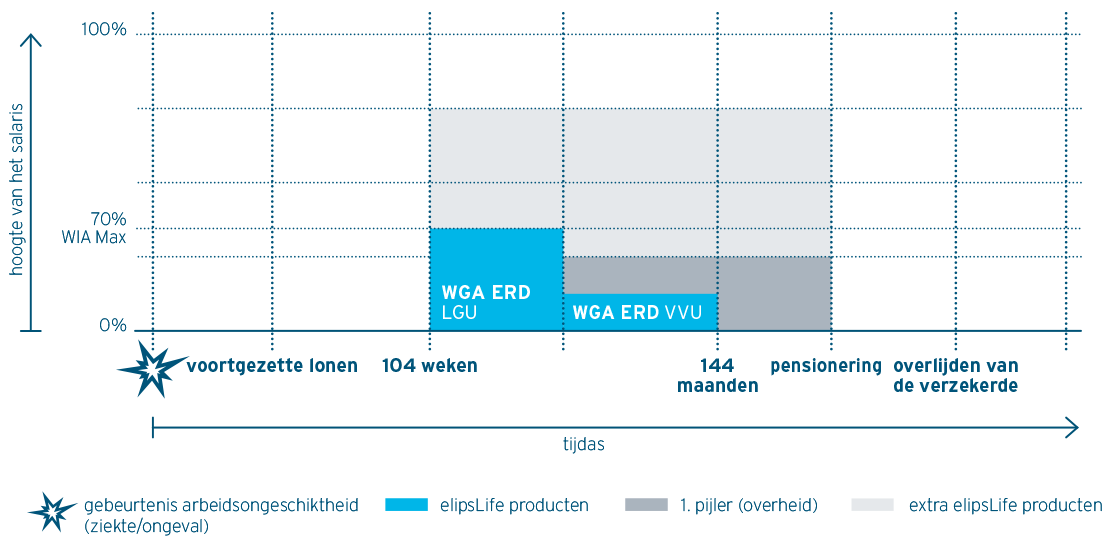

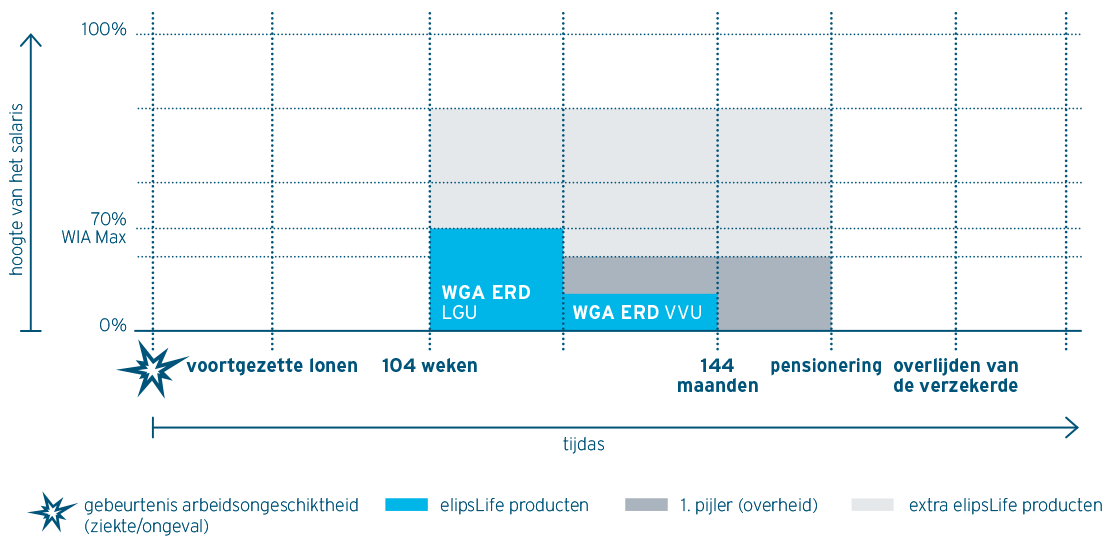

WGA-Eigenrisicodragerverzekering

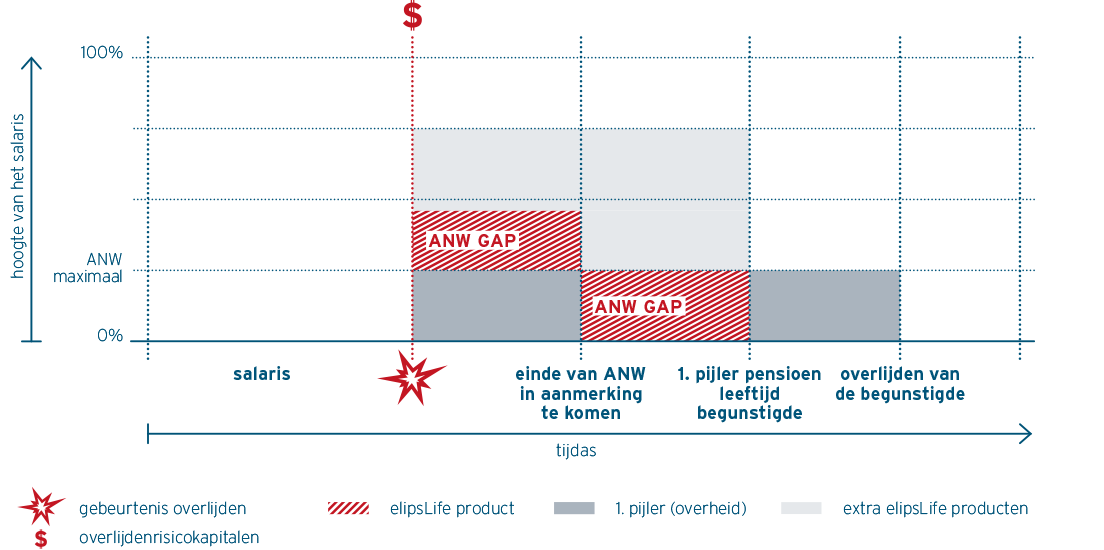

Collectieve ANW-Hiaatverzekering

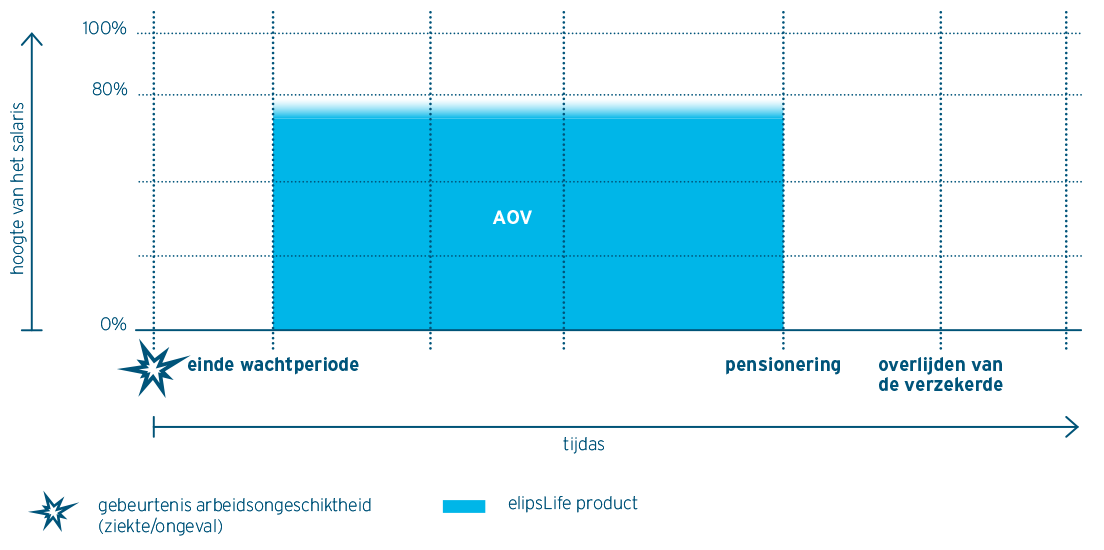

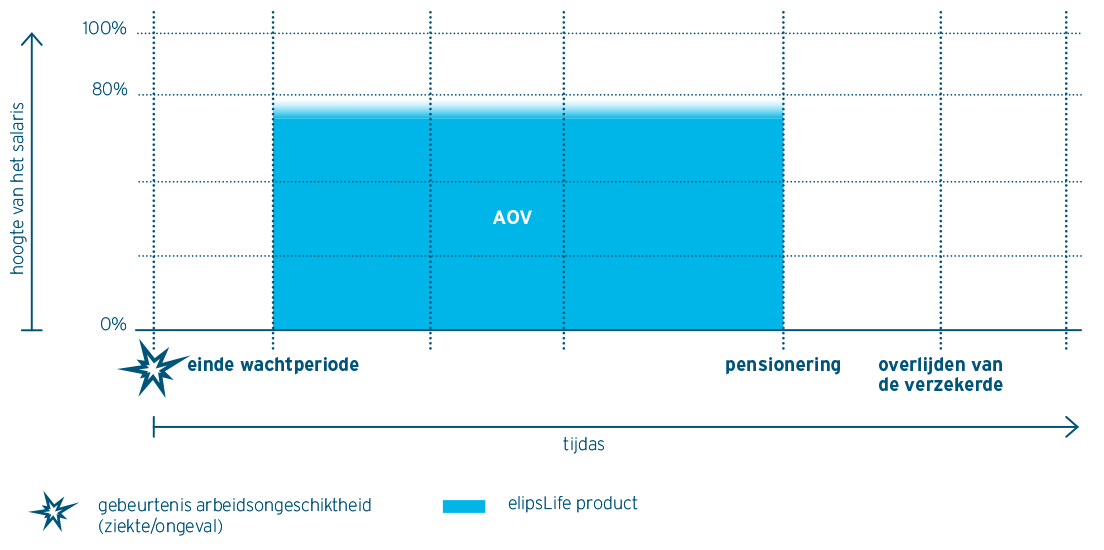

AOV

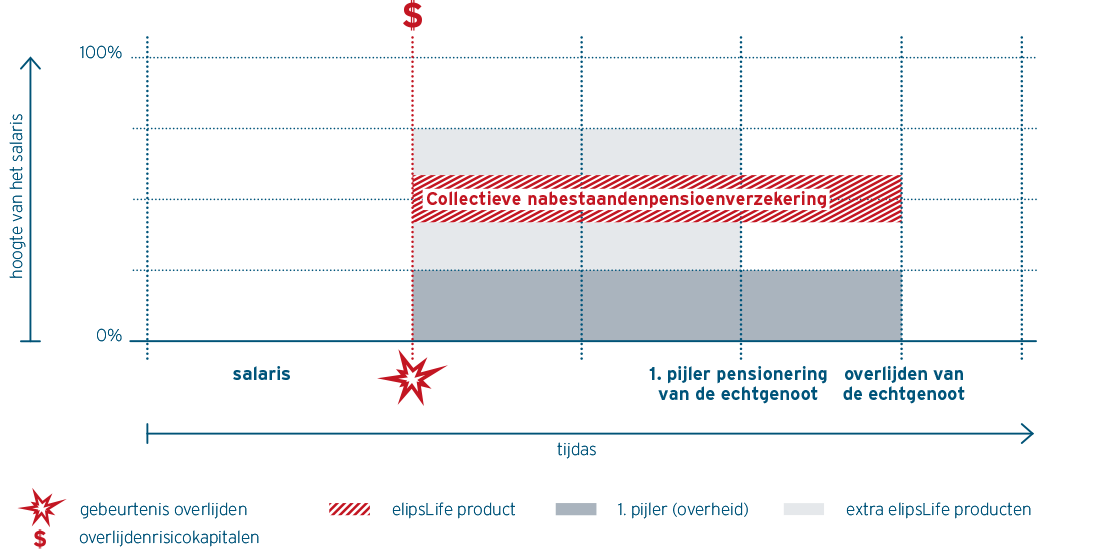

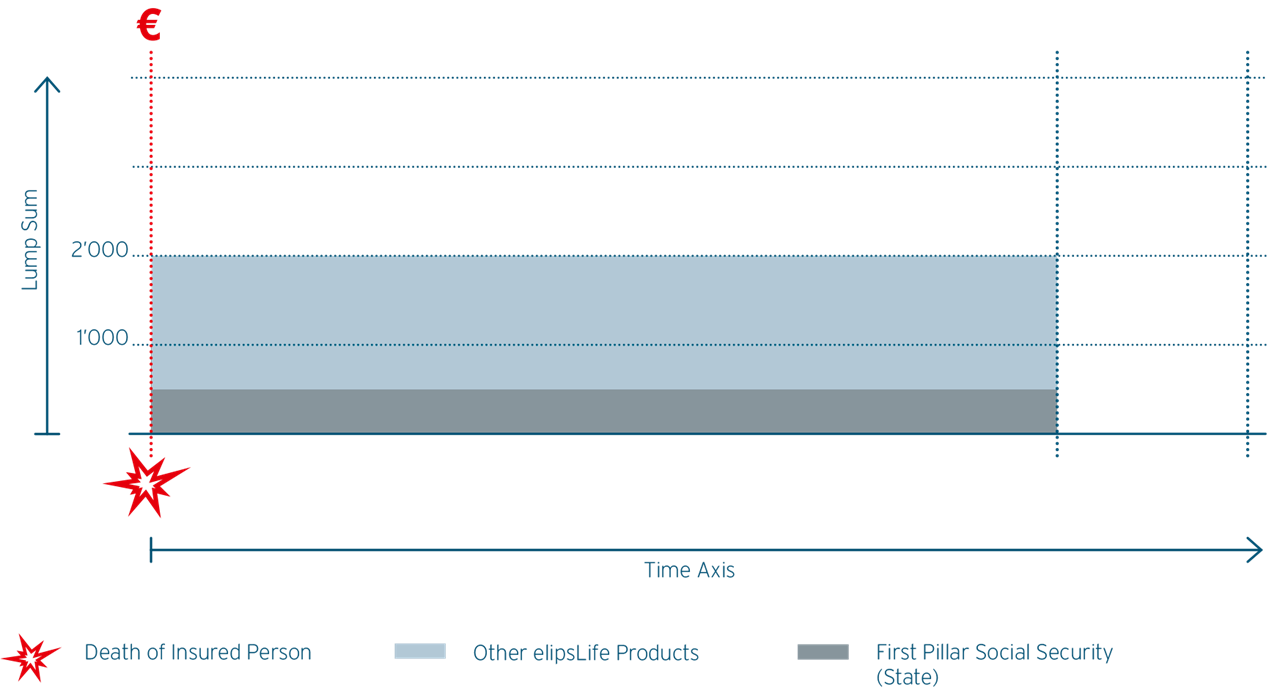

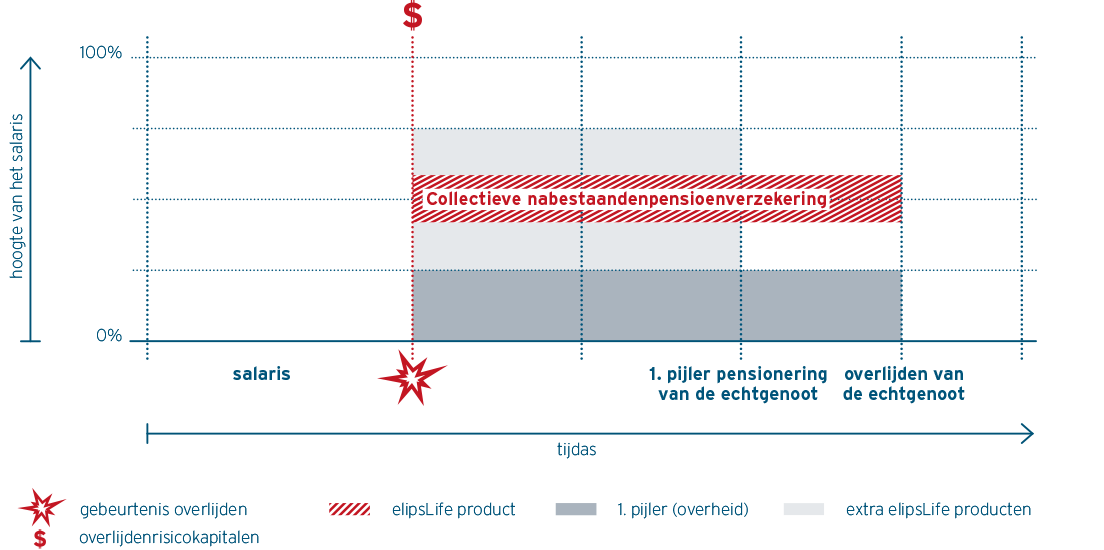

Collectieve Nabestaandenpensioenverzekering

Exceptional products: solution-oriented and innovative

elipsLife offers insurance against the financial impact of illness and accident. We focus on the specific risks and needs of the client at all times, with a range of products for both companies and brokers. These are:

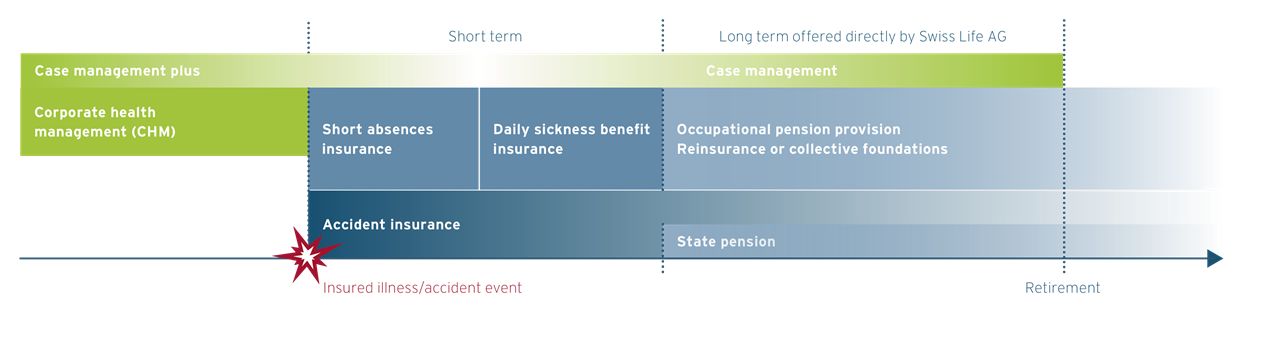

Daily sickness benefit insurance

elipsLife daily sickness benefit insurance gives your business full peace of mind if one of your employees falls ill and becomes incapacitated. Comprehensive cover avoids any gaps and provides the benefits the employer wants and needs.

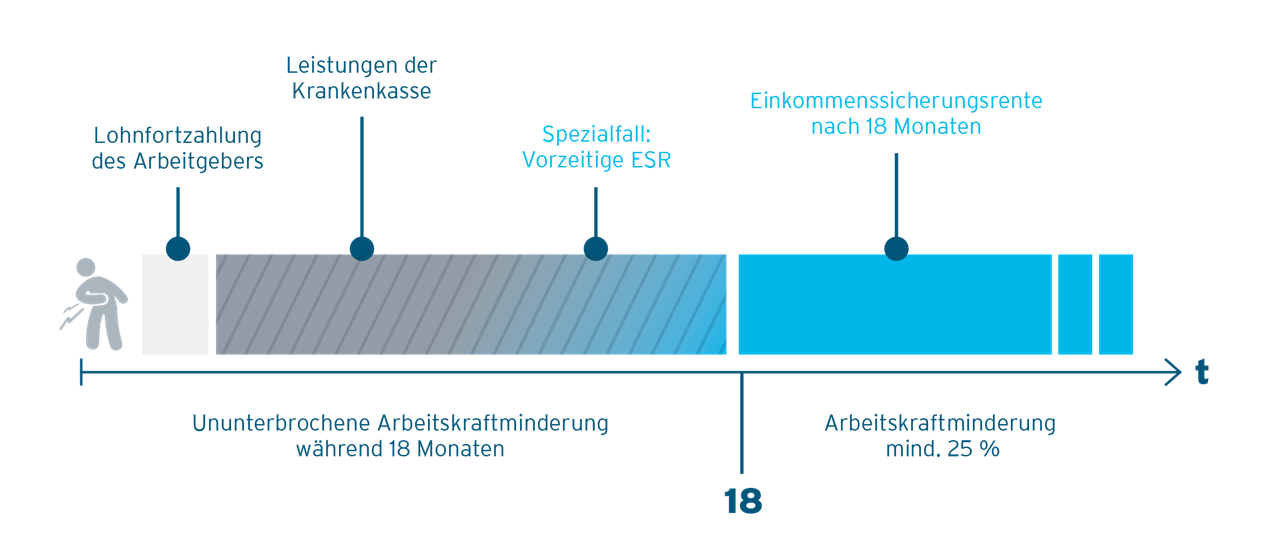

Entitlement to wage replacement benefits in the case of sickness-related incapacity to work is governed by the Swiss Code of Obligations, but ends after only a few short months. elipsLife closes this coverage gap with competitive daily sickness benefits insurance under the Swiss Insurance Policies Act (IPA). Following a qualification period determined by the employer, elipsLife solutions guarantee that they will be compensated for continuing to pay a sick employee’s salary – for up to two years.

Case management as an additional service

Case management forms part of our corporate health management (CHM) program, which helps companies to prevent illness, manage repeated absences and reintegrate its employees into the workforce. Professional case management keeps your daily sickness benefit insurance premiums steady and can even reduce them. Click here for more information.

Accident insurance

Mandatory accident insurance

Insurance against occupational accidents and illnesses is compulsory for all employees in Switzerland and Liechtenstein under the Swiss Accident Insurance Act (AIA) and the Liechtenstein Accident Insurance Act (UVersG) respectively. What’s more, all employees who work more than eight hours a week for the same employer must also be insured against non-occupational accidents.

elipsLife mandatory accident insurance provides all of the elements of cover required by law, such as wage replacement benefits in the form of a daily allowance if an employee is unable to work, the necessary benefits to cover care, and pension benefits in the event of disability and death.

Supplementary accident insurance

Supplementary accident insurance extends the benefits paid under mandatory accident insurance in line with the client’s particular needs. It is a good choice

- for employees paid more than the maximum covered by the AIA.

- for the entire workforce over and above mandatory AIA benefits. For example, it might pay for inpatient hospital treatment on a private ward, or additional lump-sum benefits in the event of death or disability.

- to insure special risks for which cover is limited or excluded under mandatory accident insurance.

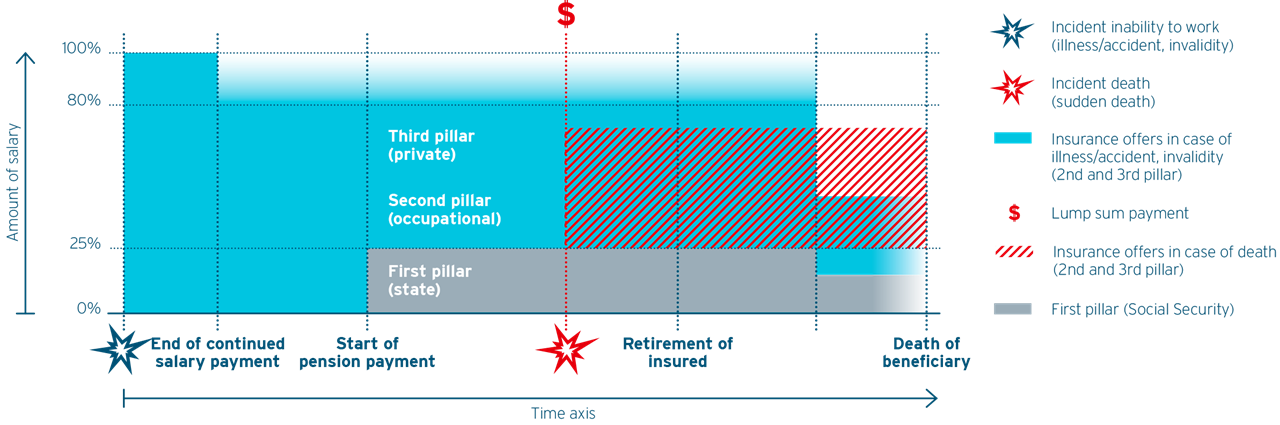

Occupational pension provision: reinsurance solutions for biometric risks

Reinsurance for occupational pensions enables companies’ own pension funds and collective foundations to insure the biometric risks of disability and death with elipsLife.

The advantages of congruent reinsurance from elipsLife:

- Benefits are replicated and insured in accordance with the Pension Regulations

- No over- or underinsurance

- Case management forms an integral part of reinsurance

Cover as set out in its regulations enables the pension fund to budget with certainty and to focus on the challenges of occupational pension provision. The fund can also hand over the management of death and disability cases to elipsLife to keep its own administrative costs down.

Case management forms an integral part of any chosen elipsLife reinsurance solution. It benefits corporate clients with their own pension funds, and their employees, because it provides active support in the face of disability or a person becoming unable to work.

Our products

Accidents: elipsLife offers insurance cover against the economic consequences of occupational and non-occupational accidents through a customizable policy that adapts to the needs of each client.

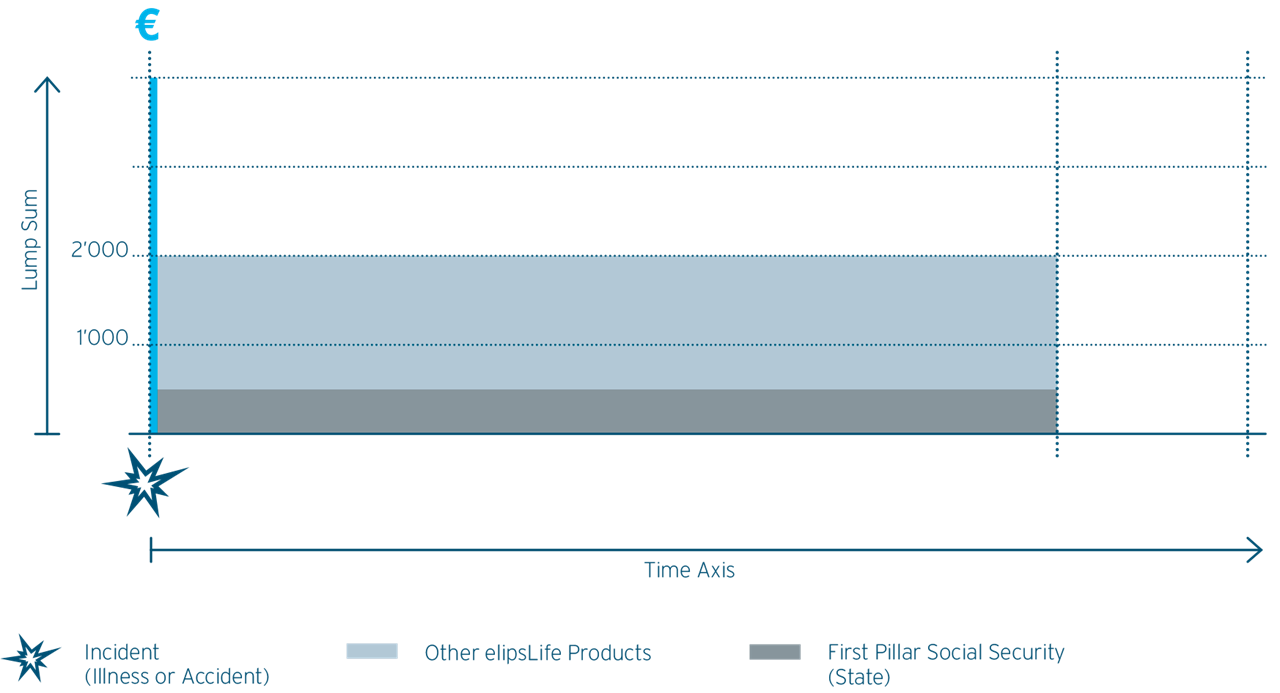

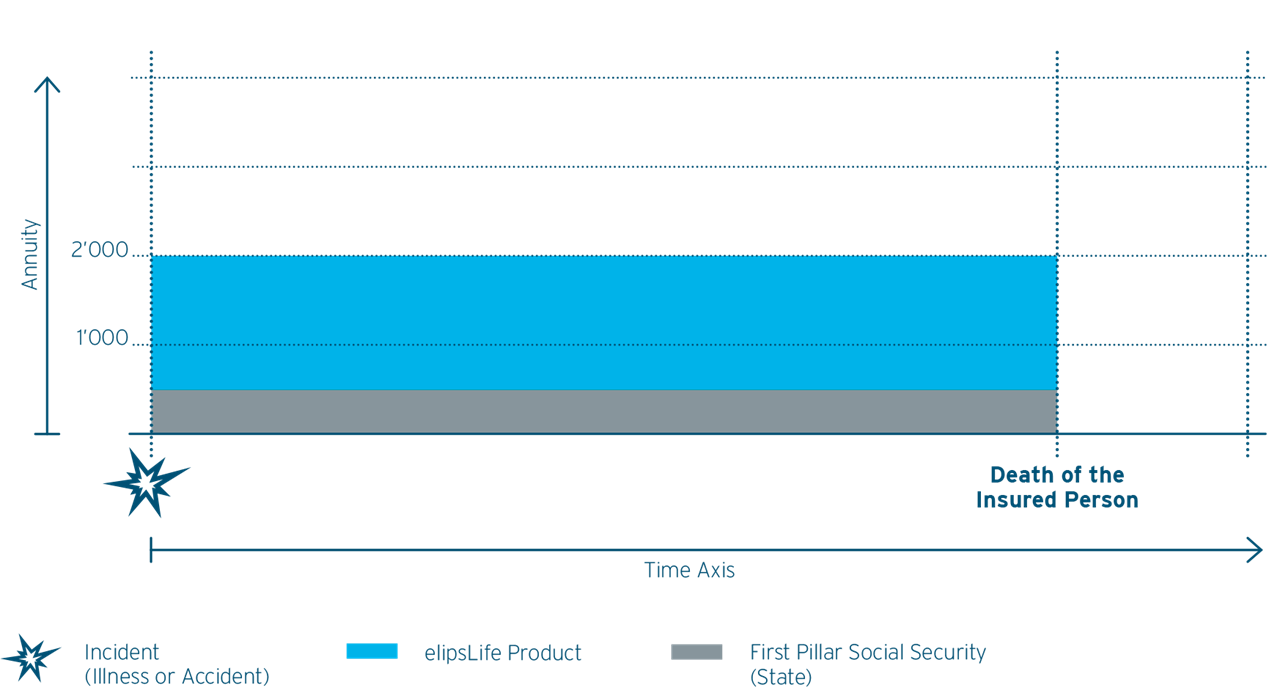

Permanent Disability due to Sickness (IPM): In combination with our accident insurance product, we offer coverage against the financial consequences of permanent disability due to illness, whether resulting from obligations under national collective labour agreements or company agreements.

Überzeugende Produkte: lösungsorientiert und innovativ

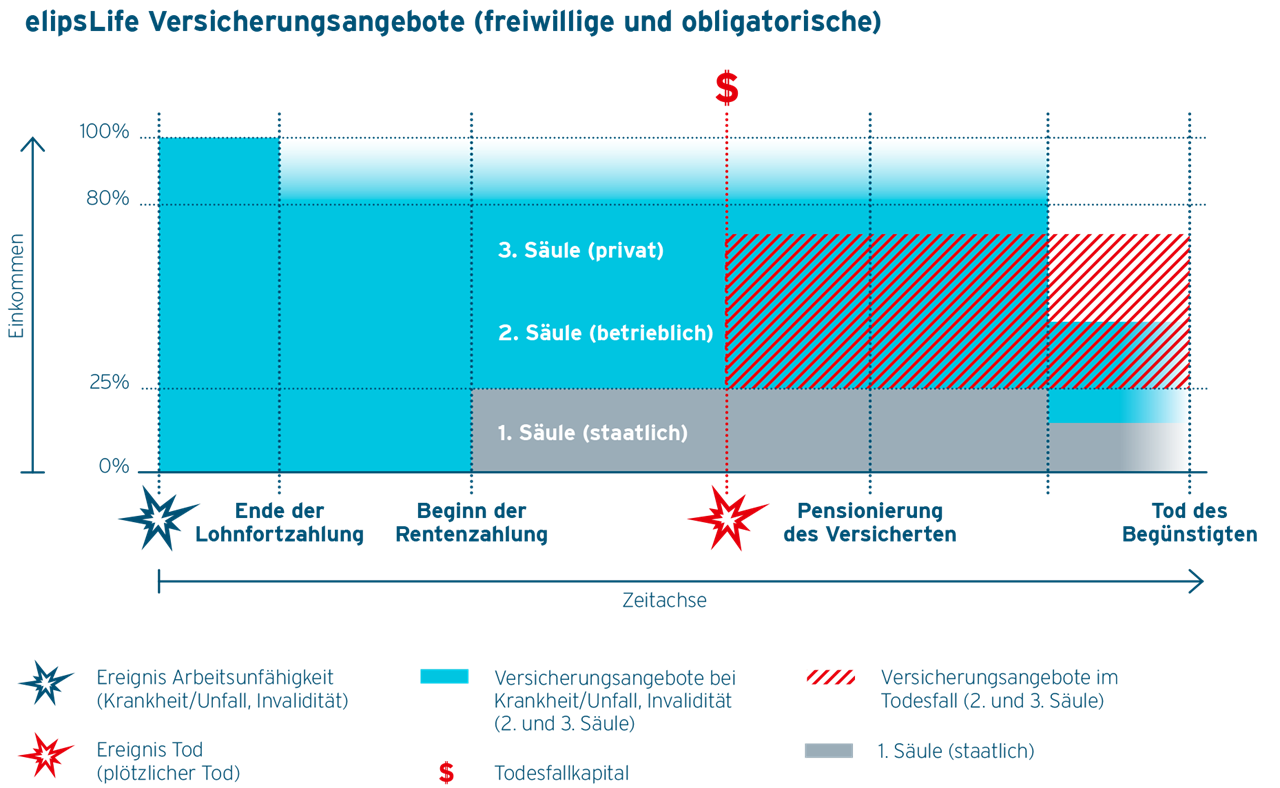

elipsLife bietet Versicherungen für Krankheit, Unfall, Invalidität und Tod an. Viele Unternehmen sind mit Deckungsfragen konfrontiert, die einen flexiblen Risikoträger erfordern. Seien es Versicherungsfragen rund um die demografische Entwicklung in Unternehmen, Fachkräftemangel, Mobilität von Topmanagern, Restrukturierungen, Mergers & Acquisitions, Sicherung von Unternehmensanteilen oder Besitzstandswahrung – elipsLife hat für alle Problemstellungen optimale Risikotransfermodelle erarbeitet.

Betriebliche Einkommenssicherung

- Arbeitsunfähigkeitsrente

- Einkommenssicherungsrente

- Todesfallkapital

{"commands":[{"click":"chrome:field:editcontrol({command:\"webedit:editlink\"})","header":"Link bearbeiten","icon":"/temp/iconcache/networkv2/16x16/link_edit.png","disabledIcon":"/temp/link_edit_disabled16x16.png","isDivider":false,"tooltip":"Editiert das Linkziel und Linkaussehen","type":""},{"click":"chrome:field:editcontrol({command:\"webedit:clearlink\"})","header":"Link löschen","icon":"/temp/iconcache/networkv2/16x16/link_delete.png","disabledIcon":"/temp/link_delete_disabled16x16.png","isDivider":false,"tooltip":"Löscht den Link","type":""},{"click":"chrome:common:edititem({command:\"webedit:open\"})","header":"Das zugehörige Item bearbeiten.","icon":"/temp/iconcache/office/16x16/cubes.png","disabledIcon":"/temp/cubes_disabled16x16.png","isDivider":false,"tooltip":"Das Item im Content Editor bearbeiten","type":"common"},{"click":"chrome:rendering:personalize({command:\"webedit:personalize\"})","header":"Personalisieren","icon":"/temp/iconcache/office/16x16/users_family.png","disabledIcon":"/temp/users_family_disabled16x16.png","isDivider":false,"tooltip":"Personalisierungsoptionen für diese Komponente erstellen/bearbeiten.","type":"sticky"},{"click":"chrome:rendering:editvariations({command:\"webedit:editvariations\"})","header":"Varianten bearbeiten","icon":"/temp/iconcache/office/16x16/windows.png","disabledIcon":"/temp/windows_disabled16x16.png","isDivider":false,"tooltip":"Die Varianten bearbeiten","type":"sticky"}],"contextItemUri":"sitecore://master/{67FC751E-072A-4C01-A169-80BB74C68B64}?lang=en&ver=2","custom":{},"displayName":"Link [Alternativer Wert (de)]","expandedDisplayName":null}Mehr erfahren

WGA-Vervolghiaatverzekering

WGA-Eigenrisicodragerverzekering

AOV

Collectieve Nabestaandenpensioenverzekering

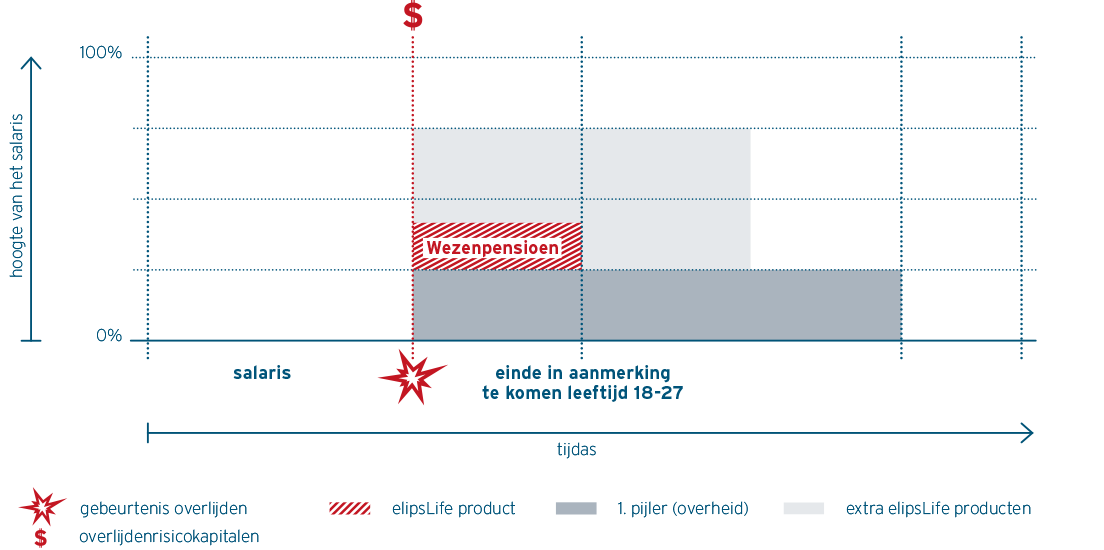

Collectieve Wezenpensioenverzekering

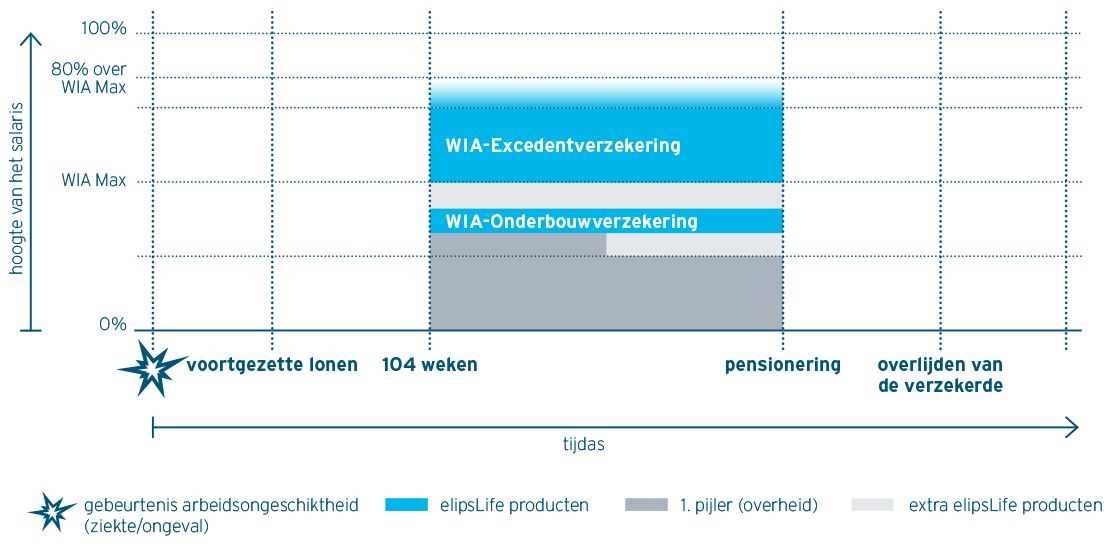

WIA-Excedentverzekering; WIA-Onderbouwverzekering

Our products

Accidents: elipsLife offers insurance cover against the economic consequences of occupational and non-occupational accidents through a customizable policy that adapts to the needs of each client.

Permanent Disability due to Sickness (IPM): In combination with our accident insurance product, we offer coverage against the financial consequences of permanent disability due to illness, whether resulting from obligations under national collective labour agreements or company agreements.

Exceptional products: solution-oriented and innovative

elipsLife offers insurance to cover sickness, accident, disability and death. Many companies are faced by complex coverage issues that call for support by a flexible risk carrier. Whether these concern insurance issues related to the mobility of top managers, restructuring projects, mergers and acquisitions, converting a defined benefit scheme into a defined contribution scheme, securing company shares or guaranteeing vested rights - elipsLife has designed optimised risk transfer models for all problems.

ANW - Hiaat

De Anw-hiaatverzekering zorgt bij overlijden voor meer financiële zekerheid voor de partner van de verzekerde. Deze ontvangt, na het overlijden van de verzekerde, iedere maand een uitkering. elipsLife biedt naast de elipsLife Anw Hiaat verzekering ook Anw Hiaat verzekeringen aan die gericht zijn op specifiek doelgroepen:

Anw-hiaatverzekering – klik hier voor meer informatie over de elipsLife Anw Hiaat verzekering.

Anw-hiaatverzekering voor medewerkers van Defensie - klik hier voor meer informatie

Anw-hiaatverzekering voor de politie – klik hier voor meer informatie

Anw-hiaatverzekering voor ambtenaren en medewerkers in het hoger onderwijs – klik hier voor meer informatie

Nabestaandenpensioen

Nabestaandenpensioen is het pensioen voor de partner en kinderen van verzekerde als deze overlijdt. Wij noemen dit ook partnerpensioen en wezenpensioen. Klik hier voor meer informatie over het elipsLife nabestaandenpensioen.

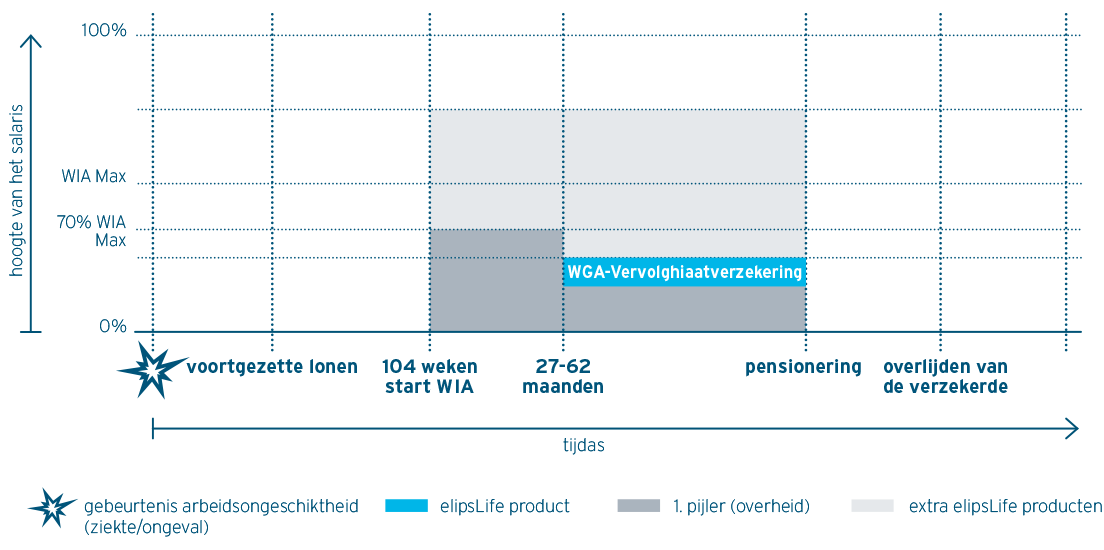

WIA verzekeringen

WGA eigenrisicodragerverzekering: De WGA-eigenrisicodragersverzekering is een verzekering voor werkgevers die eigenrisicodrager zijn voor de WGA. De werkgever is standaard verzekerd bij het UWV, maar kan ervoor kiezen eigenrisicodrager te worden. Dat betekent dat de werkgever de WGA-uitkeringen van haar werknemers zelf betaalt voor een periode van maximaal tien jaar. Met de WGA eigenrisicodragerverzekering krijgt de werkgever een vergoeding voor deze uitkeringen. Klik hier voor meer informatie over de WGA eigenrisicodragerverzekering van elipsLife.

WGA plus verzekering: De WGA Plus verzekering van elipsLife beschermt het inkomen van uw werknemers tegen de financiële gevolgen van gedeeltelijke arbeidsongeschiktheid. Klik hier voor meer informatie over de WGA plus verzekering van elipsLife.

WIA-aanvullingsverzekeringen bieden extra financiële zekerheid bij arbeidsongeschiktheid als aanvulling op een WIA-uitkering. elipsLife biedt de onderstaande WIA aanvullingsverzekeringen aan. Klik hier voor meer informatie over de WIA-aanvullingsverzekeringen van elipsLife.

- WGA-vervolghiaatverzekering

- WIA-bodemverzekering

- WGA-onderbouwverzekering

- WIA-excedentverzekering