Berufliche Vorsorge und Rückdeckung (2. Säule)

Employee benefits insurance and reinsurance (second pillar)

Occupational pension act (OPA) solutions in Switzerland

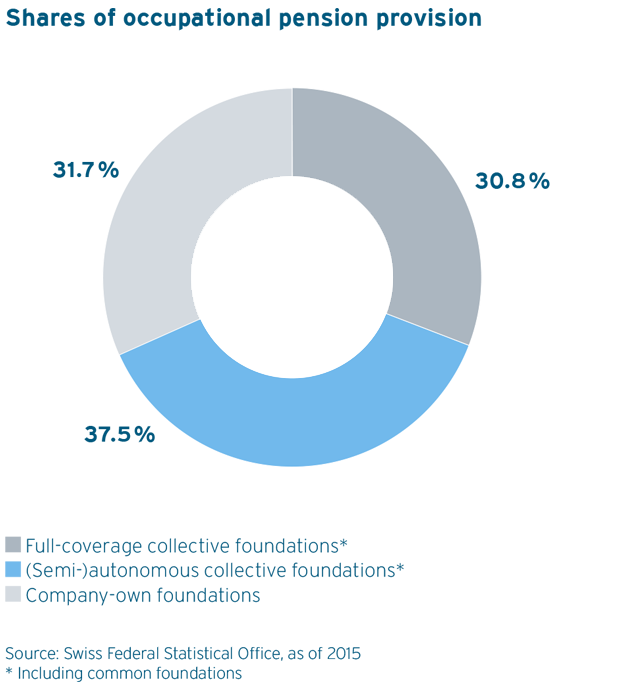

elipsLife strengthens its product line for occupational pension provision . In cooperation with the pension providers Valitas Sammelstiftung BVG and Unigamma BVG-Sammelstiftung, elipsLife offers attractive solutions for companies wishing to provide their occupational pension through the framework of a semi-autonomous collective foundation. The majority of employees in Switzerland who have occupational pension under private law belong to a (semi-)autonomous collective foundation.

Benefits of a semi-autonomous foundation solution

Sustainable and efficient occupational pension provision depends on a range of factors. It is not just a fair risk premium that is important; just as critical are factors allowing interest rates to be set as favourably as possible. elipsLife’s solutions combine the flexibility and capacity to design customised features available from a company-own pension provider with the convenience of a collective foundation. elipsLife is happy to provide you with professional support throughout the implementation of exclusive occupational pension provision that includes a wide range of design options. And with sustainable, persuasive asset management solutions too.

Differences compared with full-coverage insurance

Transparency

Each component of the premium and contribution is applied for a matching purpose in order to avoid any cross-subsidisation between pension and insurance. elipsLife’s solutions can also generate a precise breakdown of the administration costs, on request.

Interest

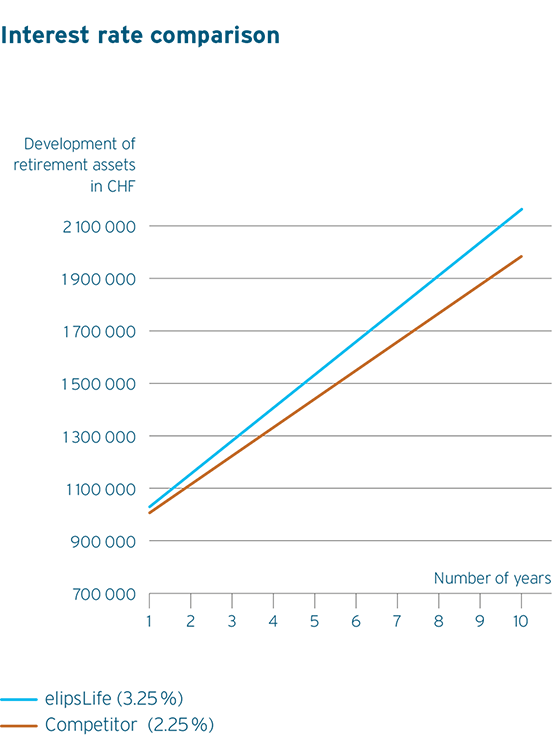

The investment returns achieved are for the exclusive benefit of the insured persons; they are not allocated to shareholders. The increased interest return then adds to the retirement assets and the benefits linked to them. Because occupational pension provision is based on a long investment horizon, this has a significant positive effect on the retirement benefits available.

Investment risks

The long investment horizon of occupational pension provision leads to lower volatility and therefore lower investment risk. Even if the pension fund does at some point face financial difficulties, restructuring measures are available. However, experience indicates that, despite the challenges of the last 10 years, this type of step has hardly ever been necessary, particularly for (semi-)autonomous collective foundations. Further, in contrast with full-coverage insurance, no charges are made for advance restructuring contributions in the form of excessive risk premiums.

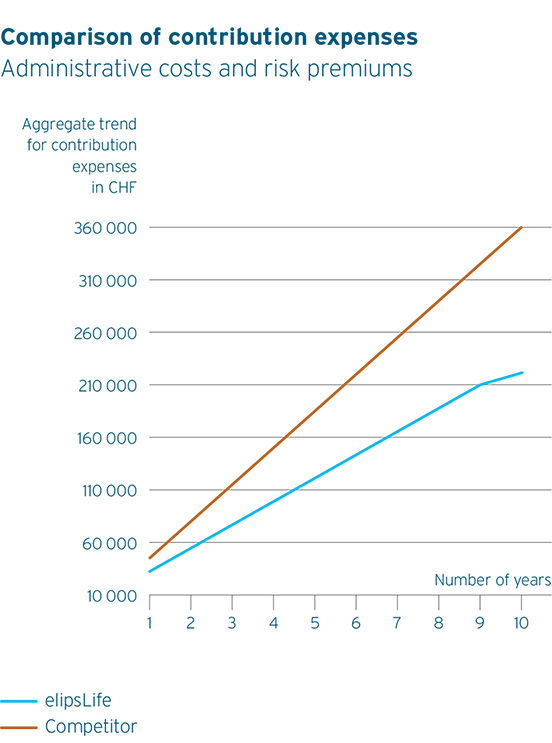

Risk premiums

The risk premiums charged by elipsLife do not include any surcharges for short-term guarantees within the retirement savings framework. As a result, the risk premium can be set at a fair and highly attractive level. In addition, the risk premium remains at the same level not just for one insurance year, as is normally the case, but is guaranteed for the entire duration of the contract.

Reserves

In order to ensure that any particular coverage ratio does not fall below a specified threshold, reserves for fluctuations in asset values are established for each pension fund. If a contract is terminated, these funds are allocated in full to the pension fund.

The right solution for every client

elipsLife has the right pension solution for every need: elipsLife OPA classic is the ideal solution for small companies seeking a transparent, straightforward solution with clearly-defined key parameters and joint, semi-autonomous liability.

elipsLife OPA flex is perfect for larger companies and all clients who want maximum flexibility. This solution allows a high degree of freedom in selecting investment strategy, custody bank, investment classes and biometric reinsurer. For clients who prefer an investment strategy based on sustainability, there is elipsLife OPA sustainable. With this solution, the client is able to design their investment strategy based partly or wholly on sustainable securities.

elipsLife OPA classic

elipsLife OPA classic is designed on a modular basis and offers a choice from a range of savings and risk hedging modules, which can be combined relatively freely. It is therefore possible to reproduce all the standard SME pension models in the market. Tailored solutions can be created for larger entries to the scheme. elipsLife also offers particularly attractive administration costs of CHF 200 per person and year with this solution.

elipsLife OPA flex

Autonomous structure

This solution’s key feature is that each pension fund has its own individual, undiluted coverage ratio. This avoids any risk of the need to finance any structurally inopportune new entries by other employers through investment returns or restructuring measures. In addition, the relatively small number of foundation pensioners are managed separately from the pension fund.

Flexible asset management

elipsLife OPA flex is focused on client needs. The clients themselves are able to select the investment strategy, the asset manager and the custody bank – and, if there are no special requirements, to place their trust in established partnerships. There are five strategy models to choose from, each offering different target returns. Additionally, elipsLife provides an option for insured persons to design their investment strategy based on their own individual needs (Article 1e of the Occupational Pension Ordinance, OPO 2).

Administration

If required, clients can access the details of their insured persons via a modern application, make changes and perform simulations. Annual administration costs amount to CHF 260 per person.

elipsLife OPA sustainable

Sustainable asset management

elipsLife OPA sustainable offers the same benefits as elipsLife OPA flex. In addition, asset management is focused on sustainable investments. There are five investment strategies to choose from, each offering different target returns, and always with a proportion aimed at sustainability. This allows investors with a long-term orientation to contribute to sustainability, even from a pension perspective.

An example of the effects of different contributions and interest credits on the employer and the insured

Basis:

Printing company, 18 insured (of which 4 are female), pensionable payroll CHF 505 350, accrued retirement assets CHF 993 145, salary limits as per the BVG, disability pension 45% of pensionable salary, partner’s pension 60% of disability pension, orphan’s/child’s pension 20% of disability pension, retirement credits 9% / 12% / 17% / 20% of the BVG salary.

Risk premiums and administrative costs:

Based on own calculations: The «competitor» contribution expenses were estimated on the basis of a per capita cost premium of CHF 480 p.a. (elipsLife CHF 260). The difference in the risk premium was calculated based on a specific quotation combined with past experience. The interest rate difference derives from a comparison with competitors where pension funds cannot actively participate in the management of their assets and the ratio between retirement pensioners and active insured is unfavourable.

Comprehensive solutions from a single source

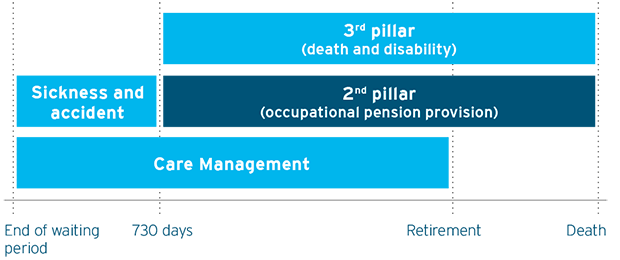

elipsLife covers all biometric risks relating to sickness, accident, disability and death from a single source. The focus is placed on occupational and private pension provisions for death and disability. elipsLife has an established position in the market as a provider of pension solutions and for the daily sickness benefit and accident insurance segments.

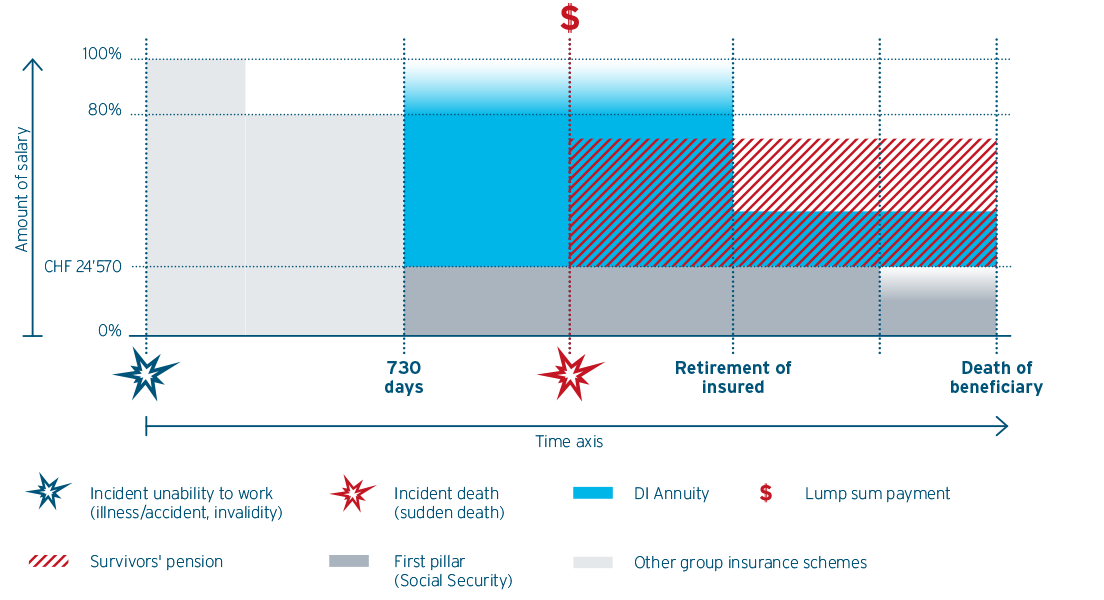

As a result of the historical development of social insurance legislation, there is a variety of insurance products available to deliver earnings replacement benefits, if ill health leads to a reduction in an employee’s functional performance. The coordination of benefits within the branches of social insurance and the reciprocal effect on private insurance products have grown over many years. The result is a complex framework, widely interconnected and with a broad variety of design options in terms of benefits.

With all these different types of insurance, the employer usually acts as the policyholder. As a total solution provider, elipsLife offers the employer centralised management of their employees, from the start of the person’s incapacity to work right up to, in the worst case, death. The client is always guaranteed to experience the best possible coordination of insurance cover in terms of daily sickness benefit, accident insurance and occupational pension provision.

This generates added value for the client – if the first-, second- and third-pillar products are provided by different companies, the client can be either overinsured or suffer gaps in insurance cover; claims processing is also better managed by a single company.

elipsLife is known for its uncomplicated service and personalised support. Thanks to our decentralised and multilingual teams, clients and their employees are guaranteed excellent support in their mother tongue. A culture of open feedback and proximity to our clients are also reflected in the pragmatic solutions we can create if things do not go according to plan.

elipsLife, as a total solution provider, offers comprehensive advice, single-source coordination of your insurance cover and all-round support in the event of a claim. Occupational pension provision from elipsLife offers the following unique advantages:

- You benefit from lower administration costs, thanks to reduced coordination needs

- You experience personal and uniform service across all types of personal insurance

- You enjoy a tailored and consistent solution

- You receive professional and transparent benefit coordination and comprehensive support from your administration contact

- You benefit from the early and effective involvement of our case management processes

- Additionally, you benefit from attractive combined discounts and lower premiums as a result.