The pandemic is disrupting historical mortality rates and complicating future projections. In a recently published study1, the Swiss Re Institute found that life insurance providers are particularly affected by mortality factors and longer-term health consequences that are still poorly understood.

The studies published to date show that men are more likely than women to die from a coronavirus infection. There are also clear correlations between age and the death rate. According to the Swiss Re Institute, people who are overweight, come from poorer backgrounds and suffer from a number of pre-existing conditions also have a higher risk of becoming severely ill or dying as a result of the coronavirus.

Prevalence in nursing homes

The Swiss Re Institute study, like others, identifies the spread of the virus in nursing homes as one of the main reasons for high mortality rates. In the US alone, 30% to 40% of deaths occurred in nursing homes. A similar pattern has been observed in other Western countries, although with large variations in mortality in nursing homes due to the coronavirus.

In Switzerland, around 49% of the people who died due to the coronavirus did so in a nursing home. However, the proportion of people who died in hospitals after living in a nursing or retirement home cannot be determined. Therefore, the total number of residents of nursing and retirement homes who died in connection with the coronavirus remains unknown. According to the Swiss Federal Office of Public Health, more people died in nursing and retirement homes (2,686 deaths) than in hospitals (2,138) during the second wave.

Effective protective measures in retirement and nursing homes were often introduced too late. According to the Swiss Re Institute, the coronavirus shortened the lives of many nursing and retirement home residents by a few months to several years.

Significant excess mortality

The Swiss Re Institute based its assertions on excess mortality on a study by EuroMOMO (European Mortality Monitoring), which compared excess mortality during the last five years (June 2015 to 12 June 2020) in European countries. According to this evidence, the coronavirus caused significant excess mortality.

More people died than can be attributed to the coronavirus. This is for the following reasons: deaths in nursing homes and other locations were related to the coronavirus, but were not counted as deaths caused by the virus. Premature deaths also occurred because treatments for other diseases such as cancer were interrupted due to the pandemic.

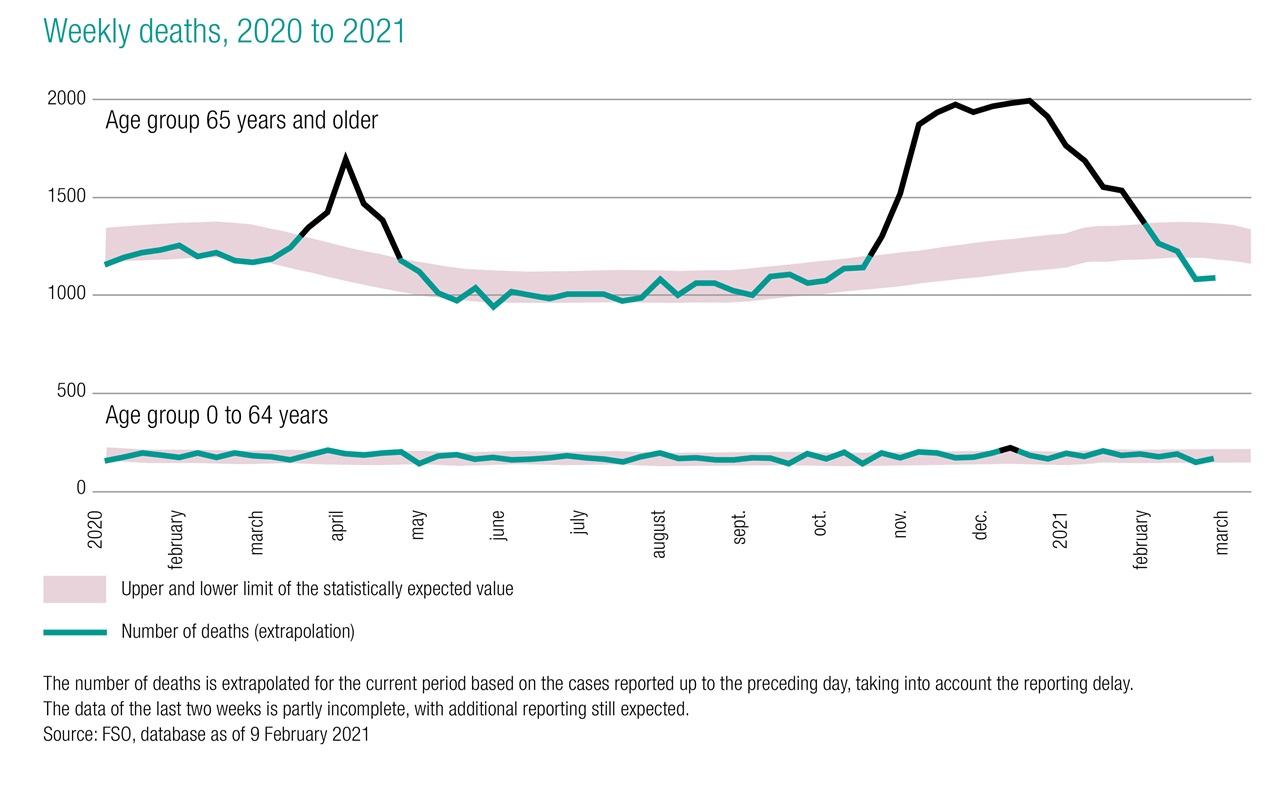

In Switzerland, according to a review by the Swiss Federal Statistical Office, more than 400 additional deaths occurred within one week in mid-April 2020 compared to the normal mortality level. Only the age group over 65 was affected. The coronavirus did not have a statistically significant effect on mortality in younger people.

From mid-October and the onset of the second wave, mortality among those over 65 years of age again rose above the long-term average. Mortality among younger age groups remained within the normal range.