A disability impacts life immensely. Emotionally, but financially as well. People do not always realise this. In case of partial disability, for example, the state benefits are not always sufficient to cover a certain standard of living. With WGA Plus Insurance by elipsLife employers protect their employees against the financial consequences of a partial disability. You offer an attractive employee benefits scheme that can be a key element for success in human resources management. A win-win for employers and employees!

When an employee is ill for more than two years …

Is an employee unable to work (full time) following an accident or illness? Then employers have to ensure the income in the first two years. This is the law. After 104 weeks, they receive a final assessment from social security benefits administration agency UWV. UWV decides whether or not the employee is unable to work and for what percentage.

… employers can protect the income up to 70 % or 75 %

In most cases, the employee then receives a state benefit. But, this benefit is often not enough to maintain the standard of living. With WGA Plus Insurance the employee receives extra income, up to 70 % or 75 % of the salary before disability. The maximum insured salary is equal to maximum social security income level as published by the UWV.

This is how WGA Plus works

The insurance follows the UWV assessment

After an average waiting period of two years, the UWV determines the percentage occupational disability. If the employee becomes incapable of working between 35 % and 80 %, then he or she will receive a supplementary benefit from WGA Plus Insurance of elipsLife each month.

WGA Plus supplements the remaining income of the employee …

… up to 70%

The remaining income includes the social security benefits from UWV and any salary earned during partial disability. With WGA Plus 70 % of the insured salary before disability is guaranteed.

… or up to 75%

Does the employee work more than half of his remaining capacity for work? Then the benefit level of WGA Plus increases up to 75 % of the insured salary before disability.

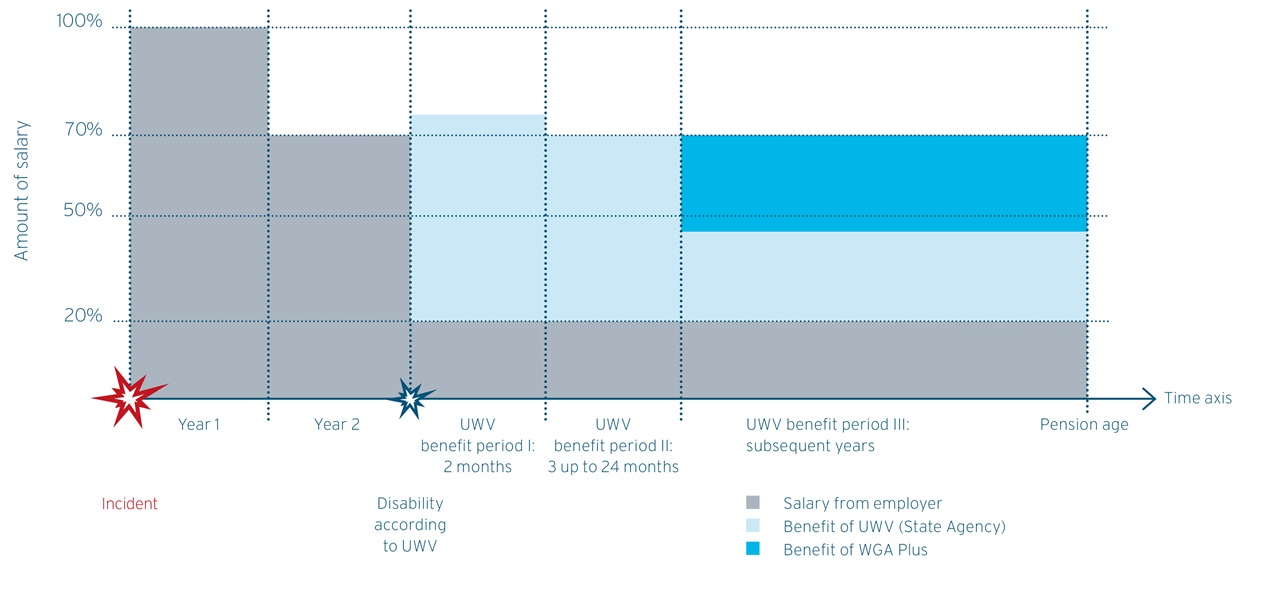

WGA Plus graph

This graph shows the income level of WGA Plus in addition to social security benefit and part-time work.

The benefits of WGA Plus: an example

Mrs Miller has been sick for a while. Unfortunately, it turns out to be more than just a short time illness. In the first two years she still receives her salary. After this standard waiting period of two years, UWV evaluates her level of disability. UWV decides she is incapable of working for 50%.

But Mrs Miller continues to work for only 20 %. Her income drops considerably. Fortunately her employer has WGA Plus Insurance from elipsLife. The benefit of this insurance is supplementary to her remaining salary and the benefit from UWV. She now reaches a total income of 70 % of her insured salary before disability.

Employees are covered from the first day of the contract

All employees that qualify for the 'Work and Income (Capacity for Work) Act' (WIA) are covered. The first day of sickness must always be within the contract dates and after the first day of employment.

The benefit ends in the following situations:

- The occupational disability percentage drops below 35%.

- The occupational disability percentage increases above 80%.

- UWV ends the WGA benefit.

- The employee reaches the end age of the insurance.

- The employee dies before this.

The insurance cover ends in the following situations:

- The employment contract between the employer and the employee ends and the employee is not sick or disabled.

- The employee reaches the end age of the insurance.

- The insurance contract ends and the employee is not sick or disabled.

Key product features

- All employees are insured.

Participation is mandatory

- There is a maximum insured amount.

The insured amount is based on the salary of the employee with a maximum of the social security income level. The government decides this maximum and this is adjusted each year (WIA-indexation).

- WGA Plus is linked to the indexation of the UWV benefit.

The benefit increases each year with the percentage as published by the State Agency UWV. Most likely the benefit will keep its value. Except when prices increase with a higher percentage than the benefit.

- Benefits are paid out every month.

A total solution for your company

elipsLife offers a full range of insurance solutions from a single source. WGA Plus is a tailor-made risk solution for securing income. It is a simple and powerful income protection for your employees. Your advantages are:

• You show your social responsibility by offering income protection for employees.

• You are a more attractive employer.

• You pay competitive premium rates.